Mastering the Mortgage Process for Lenders: A Comprehensive Guide to Key Steps

Understanding the Mortgage Process for Lenders

The mortgage process is a complex journey requiring detailed understanding and precision. For lenders, mastering the mortgage process for lenders means facilitating successful transactions, reducing risks, and ultimately ensuring customer satisfaction. This comprehensive guide examines each critical phase involved in the mortgage process, breaking it down from application to closing and everything in between.

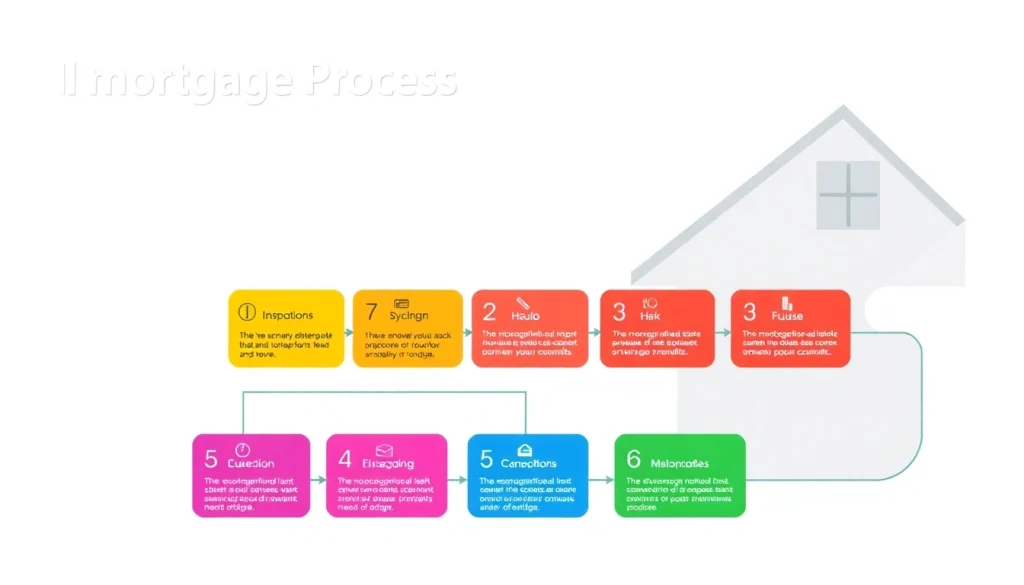

1. Steps Involved from Application to Closing

The mortgage process typically consists of several key stages, each serving a distinct purpose. Below is a detailed look at the steps involved:

Step 1: Application

The first step in the mortgage process is completing a loan application. This document gathers a borrower’s financial and personal information, and lenders often provide a variety of methods—online applications, in-person meetings, or phone discussions—for borrowers to complete this process. Key details included in this application may comprise:

- Personal information (name, address, SSN)

- Employment history

- Income sources

- Assets and liabilities overview

Step 2: Pre-Approval

Following the application, the lender assesses the borrower’s creditworthiness and overall financial health, leading to a pre-approval decision. This process entails a rigorous examination of credit history and may require supplementary documentation such as tax returns and W-2 forms.

Step 3: House Shopping

Once pre-approved, borrowers can start house hunting. This phase integrates cooperation between lenders, borrowers, and real estate agents while ensuring that prospective homes align with the borrower’s pre-approved limits.

Step 4: Loan Processing

After selecting a property, the loan processing phase begins. Loan processors will organize and verify documentation, including employment verification and appraisal orders, while ensuring compliance with lending standards.

Step 5: Underwriting

The underwriting phase involves a lender’s assessment of risk. Underwriters will scrutinize the loan file, including the borrower’s credit profile, employment history, and the property appraisal, to make an informed decision on loan approval.

Step 6: Closing

The final phase is the closing meeting, where the lender, borrower, and other parties finalize the deal. During this session, closing documents are signed, and the loan is funded, enabling the borrower to take possession of the property.

2. Key Terms and Definitions

Understanding the mortgage process requires familiarity with specific terminology used in the industry. Here are foundational terms that lenders and borrowers need to know:

Amortization

Refers to the gradual repayment of a loan over time, typically through monthly payments that cover both principal and interest.

Loan-To-Value (LTV) Ratio

This ratio compares the loan amount to the appraised value of the property, influencing both risk assessment and interest rate settings.

Debt-To-Income (DTI) Ratio

The DTI ratio measures the borrower’s monthly debt obligations against their gross monthly income. Lenders often use this metric to gauge financial health.

Escrow

A neutral third-party account that holds funds or documents until specific conditions are met, commonly utilized during the closing process.

3. Common Challenges Lenders Face

Navigating the mortgage process can present challenges that lenders must be prepared to address, including:

Verification Delays

Delays in income, asset, or employment verification can prolong the loan processing timeframe. Lenders can mitigate this by establishing clear timelines with borrowers to ensure prompt documentation submission.

Appraisal Issues

Appraisals may sometimes fall short of expectations, which can negatively affect the LTV ratio. Lenders should consider working with reliable appraisers and ensure clear communication with borrowers regarding potential outcomes.

Compliance Challenges

Adhering to legal and regulatory requirements can be cumbersome. Regular training and automated compliance systems can help lenders stay updated and reduce the risk of violations.

Pre-Approval Process Explained

1. Importance of Pre-Approval

Pre-approval is a crucial step in the mortgage process, as it provides borrowers with a clear understanding of how much they can afford and streamlines the overall transaction. It also enhances the borrower’s competitiveness in a tight real estate market.

2. Required Documentation and Fees

During pre-approval, borrowers must submit various documents, including:

- Proof of income (pay stubs, tax returns)

- Credit history report

- Asset documentation (bank statements)

Some lenders may charge fees for credit checks and processing, which borrowers should verify before proceeding.

3. Strategies for Speeding Up Pre-Approval

To fast-track the pre-approval process, lenders can advise borrowers to:

- Gather essential documents prior to consultation

- Maintain updated records of financial activities

- Respond swiftly to lenders’ requests for additional information

Navigating Loan Processing

1. Overview of Loan Processing Steps

Loan processing is a detailed procedure involving multiple steps, such as:

- Document collection and verification

- Creating a loan file in the lender’s system

- Sourcing third-party services, including appraisals and title searches

2. Role of the Loan Processor

The loan processor acts as a liaison among all parties involved, ensuring that all necessary documentation is complete and accurate, and that the process runs smoothly.

3. Tips for Streamlining the Process

To enhance efficiency in loan processing, lenders can apply these strategies:

- Utilize technology for document management and tracking

- Implement checklists for required documentation and follow-ups

- Maintain open lines of communication with borrowers and third-party vendors

Underwriting the Mortgage

1. What Underwriters Look For

Underwriters assess several key factors to determine the risk associated with a loan application, including:

- Credit score and history

- Debt-to-income ratio

- Loan-to-value ratio

- Employment stability

2. The Underwriting Timeline

The underwriting process typically takes between a few days to several weeks, depending on how quickly documentation is supplied and whether additional information is required.

3. Resolving Underwriting Issues

When underwriting issues arise, lenders can take several steps to resolve them:

- Clarify discrepancies with borrowers promptly

- Seek additional information or documentation as needed

- Work closely with the underwriting team to expedite the decision-making process

Closing the Deal

1. Final Steps Before Closing

Prior to the closing meeting, lenders should ensure that all documents are in order, all conditions have been met, and that both parties are well-informed about the proceedings ahead.

2. Understanding Closing Costs

Closing costs can be substantial, often comprising:

- Title insurance and search fees

- Appraisal fees

- Origination fees

- Recording fees

Clear communication about these costs is essential to avoid last-minute surprises for borrowers.

3. Ensuring a Smooth Closing Experience

To facilitate a comfortable closing experience, lenders can consider the following best practices:

- Confirm attendance of all necessary parties in advance

- Provide borrowers with a detailed explanation of the closing documents beforehand

- Be available for questions and support during the closing process

Conclusion

The mortgage process for lenders can be intricate, but understanding each step—from application to closing—empowers lenders to deliver efficient, effective service. By mastering the details of each phase and proactively addressing challenges and complexities, lenders can not only streamline their operations but also foster trust and satisfaction with their clients. This comprehensive approach will help lenders achieve sustained success in an evolving financial landscape.